Market HIGHLIGHTS: FMCG, media, PSU Bank stocks drag Sensex, Nifty; ITC, SBI top losers

Market LIVE: Domestic stock markets ended Monday in the red, dragged by FMCG, PSU bank and media stocks. Off its intraday lows, BSE Sensex closed at 61,624.15, down 170.89 points or 0.28 per cent. Meanwhile, Nifty 50 settled at 18,329.15, up over 20.55 points or 0.11 per cent.

Here are top highlights of today's trading session:

1) Markets traded in a narrow range with Sensex trading in 350-point range while Nifty50 traded in 90-point range.

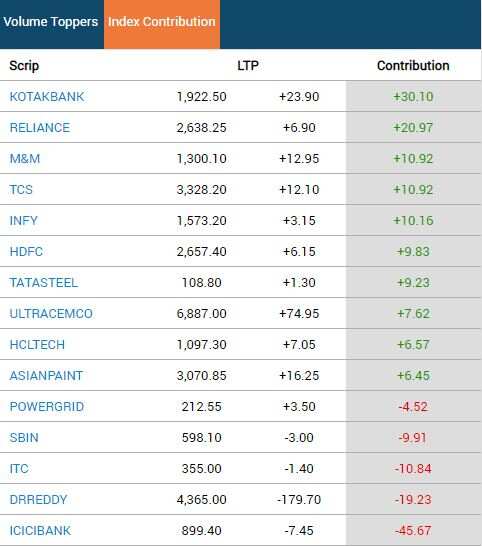

2) The top gainers were Hindalco Industries, Apollo Hospitals, Tata Motors, Grasim Industries and Power Grid while the top losers were Dr Reddy's Coal India, ITC, Hindustan Unilever and SBI.

3) In the 15- Nifty sectoral indices, the top perfrming indices were Nifty Metal (+1.73 per cent), Nifty Realty (+1.13 per cent) and Nifty (+0.87 per cent) while the worst performing indices were Nifty FMCG (-1.35 per cent), Nifty PSU Bank (-0.60 per cent) and Nifty Media (-2.40 per cent).

4) India VIX, a measure of volatility on Nifty was up 14.91 points or 3.50 per cent from te Friday closing levels.

5) Nifty Bank closed at 42,076.75, down by 60.30 points or 0.14 per cent.

6) Nifty Mid Cap 100 closed at 31,399.15, up 0.06 per cent while Nifty Small Cap 100 closed at 9,752.25, up 0.48 per cent.

7) Singapore-based SGX Nifty, an early indicator of Nifty50 movement was trading at 18,377.5, down 58.5 points or 0.32 per cent around this time. Dow Futures were trading at 33,664.50, down 83.40 points or 0.25 per cent.

8) Indian Rupee also opened strongly with gains of 28 paise at 80.54 against the US Dollar and slipped over 40 paise from day's highs. On Friday INR opened up by over a Rupee.

Catch all the UPDATES from the markets here!

Market LIVE: Domestic stock markets ended Monday in the red, dragged by FMCG, PSU bank and media stocks. Off its intraday lows, BSE Sensex closed at 61,624.15, down 170.89 points or 0.28 per cent. Meanwhile, Nifty 50 settled at 18,329.15, up over 20.55 points or 0.11 per cent.

Here are top highlights of today's trading session:

1) Markets traded in a narrow range with Sensex trading in 350-point range while Nifty50 traded in 90-point range.

2) The top gainers were Hindalco Industries, Apollo Hospitals, Tata Motors, Grasim Industries and Power Grid while the top losers were Dr Reddy's Coal India, ITC, Hindustan Unilever and SBI.

3) In the 15- Nifty sectoral indices, the top perfrming indices were Nifty Metal (+1.73 per cent), Nifty Realty (+1.13 per cent) and Nifty (+0.87 per cent) while the worst performing indices were Nifty FMCG (-1.35 per cent), Nifty PSU Bank (-0.60 per cent) and Nifty Media (-2.40 per cent).

4) India VIX, a measure of volatility on Nifty was up 14.91 points or 3.50 per cent from te Friday closing levels.

5) Nifty Bank closed at 42,076.75, down by 60.30 points or 0.14 per cent.

6) Nifty Mid Cap 100 closed at 31,399.15, up 0.06 per cent while Nifty Small Cap 100 closed at 9,752.25, up 0.48 per cent.

7) Singapore-based SGX Nifty, an early indicator of Nifty50 movement was trading at 18,377.5, down 58.5 points or 0.32 per cent around this time. Dow Futures were trading at 33,664.50, down 83.40 points or 0.25 per cent.

8) Indian Rupee also opened strongly with gains of 28 paise at 80.54 against the US Dollar and slipped over 40 paise from day's highs. On Friday INR opened up by over a Rupee.

Catch all the UPDATES from the markets here!

Latest Updates

Stock Market Today

Astral share price was down 4 per cent after the company reported a below par September quarter results. Market Expert Avinash Gorakshkar said that the stock moved up in a jiffy. The longterm prospects for this stock remain strong though it may witness volatility in the short term. The Quarterly earnings reflected margin pressure because of elevated commodity prices and the situation could sustain for next 2-3 months, he opined. His strategy in this stock is to buy on declines.

Stock Market Live: Out of the 15 Nifty Sectoral Indices, only 4 gained. The top Gainer was Nifty metal index.

-- Nifty Metal - + 1.6 per cent

-- Nifty Auto - + 0.26 per cent

-- NIFTY IT - + 1.13 per cent

-- Nifty Realty - + 0.54 per cent

Top Losers

-- NIFTY FMCG down 0.90

-- NIFTY MEDIA down 2.34 per cent

-- NIFTY PSU BANK down 0.60 per cent

NIFTY BANK 42,015.15 -0.29

Stock Maket LIVE UPDATES

Nifty Midcap +0.03%

Nifty Smallcap +0.27%

Gainers

Shipping Gainers

Dredging Corp +10.50%

GE Shipping +5.2%

Cochin Shipyard +3.20%

Mazagon Dock 2.50%

Metal Gainers

Hindalco +4.70%

Jindal Stainless +4.20%

Hindustan Zinc +4%

Nalco +3%

Hospital Gainers

Fortis Helath +9%

KIMS +6%

Fortis Malar +5.60%

Apollo Hosp +3%

Pharma Gainers

Neuland Lab +6%

Astec Life +5.20%

Glemark Pharma +4.60%

Caplin Point +3.50%

Losers

Agri losers

Shakti Pumps -15.40%

Jain Irrigation -6.11%

Avanti Feeds -2.50%

Chemical Losers

Chemcon Speciality -15.50%

DCW ltd -4.10%

Camlin Fine Sciences -2.50%

Clean Science -2.20%

PSE Losers

BHEL -6.70%

New India Assurance -5%

Coal India -2.11%

NHPC -2%

Restaurants & QSR Losers

Restaurant Brand Asia -4.60%

Speciality Restaurants -3%

Devyani International - 3.50%

MRS Bectors Food -3%

Stock Market Today: IPO Watch

KAYNES IPO

The issues has been subscribesd 4 times till now on the final day of subscription

The retail porton has been subscribed 1.4 times while non-institutional investors have suscribed this issue 5.3times

The Qualifiied Institutional Investors have subscribed the issue 7.7 times.

Inox Green Energy IPO

Day 2 and the issue has been subscribed 61 per cent.

The retail portion has been subscribed 1.8 times while QIB portion has been subscribed 47 per cent while NII portion has been subscribed 10 per cent.

Keystone Realtors IPO

The issue has opened today. Till now, 4 per cent issue has been subscribed.

The retail portion has been subscribed 4 per cent and NII 6 per cent.

Also Read: Keystone Realtors IPO Review by Anil Singhvi: Subscribe or avoid? Check recommendation here

"Today's 75 paise upmove on $ rupee seems to be more on account of mid month buying due to defence and oil. All Asian currencies are up against dollar and so are all European currencies. So feel that this upmove on USDINR can be got sold into," Anil Kumar Bhansali, Head of Treasury at Finrex Treasury Advisors LLP said.

He said that he would advise unhedged exporters to sell partly here and then wait importers to now wait for 80.50 levels again to hedge.

He opines that INR is unlikley to hit lower than 80 levels where RBI may be expected to replenish the DX reserves.

(Disclaimer: The views/suggestions/advises expressed here in this article is solely by investment experts. Zee Business suggests its readers to consult with their investment advisers before making any financial decision.)

Stock Market LIVE: Result Impact

LIC, Info Edge, Manappuram , Glenmark

Sun TV, BHEL, Restaurant Brands, Astral Ltd

Top Nifty Losers

Dr Reddy, Power Grid, ICICI Bank

Other Losers

City union bank, Apollo Tyres, Thyrocare, New India Assurance

Top Nifty Gainers

Hindalco, Tata Motors, Apollo hospitals, Grasim

Other Gainers

Exide, Dr Lal, Allcargo Logistics, Fiem Ind

Buzzing Stocks:

LIC shares were trading nearly 5 per cent up after the company posted a multi-fold jump in its net profit. The stock was trading at Rs 664.85 on the NSE.

BHEL was down 6 per cent around this time and was trading at Rs 70.10 on the NSE after the company posted a disappointing September quarter results.

Stocks to Buy from Top Analysts

1) Vikas Sethi

BUY LA OPALA RG- TGT 550 IN A YEAR

A LEADING TABLEWARE MFR, POPULAR BRANDS - LA OPALA, DIVA, SOLITAIRE

50% MKT SHARE

DEBT FREE, STRONG FINANCIALS

BUY APAR INDUSTRIES - TGT 2000 IN A YEAR

LEADER IN POWER CONDUCTORS, TRANSFORMERS, MARQUEE CLIENTS - L&T, RELIANCE JIO, KALPATARU POWER ETC.

450 DISTRIBUTORS, EXPORTS TO 100+ COUNTRIES

SOLID FUNDAMENTALS

Rakesh Bansal

SPECIAL SHOW STOCK PICKS BUY NHPC Stop Loss 35 TARGET 68-70

BUY GATEWAY Stop Loss 65 TGT 110

Hemang Jani

Praj Industries Target Price - Rs 550

· Praj Industries an accomplished industrial biotechnology company with robust order backlog of Rs32.4bn. Order backlog at historical high; execution capabilities in place

· The company has global footprint and has achieved first breakthrough order in starchy feedstock based ethanol market from Brazil during FY22.

· In domestic market, it is a market leader in first generation ethanol (E1G) space and currently, ~60% of India’s ethanol production capacity of plants use PRJ’s technology.

· Margin expansion, operating leverage, minimal capital expenditure and debt free balance sheet will push earnings growth going ahead.

Fiem Industries Target Price - Rs 2250

· Fiem Industries Ltd is engaged in the business manufacturing and supply of auto components like automotive lighting, signalling equipments, rear view mirrors, sheet metal and plastic parts.

· Company has diversified into LED Luminaries for indoor and outdoor applications and integrated passenger information system with LED display.

· Company declared strong set of Q2FY23 nos. The management has good growth visibility for next 1-2 years with increasing demand in auto space.

· The stock has a breakout of the cup and handle pattern on the monthly scale which has bullish implications and the stock is expected to scale to higher levels

Jubilant Ingrevia Target Price -750

· Jubilant Ingrevia is well positioned to deliver robust growth in the future backed by its comprehensive capex plan of Rs.2,050 crore during FY'22 to FY'25.

· The management expects performance to improve in H2FY23 driven by higher share from Specialty Chemicals, where company is scaling its capacity and capability.

· The company aims to improve its revenue mix of specialty & nutrition segment to 65% by FY27 from 46% in FY22.

The stock has formed a strong base near its 20 week averages and it is giving a breakout from the consolidation zone.

Momentum indicators are in bullish territory which indicates strength in the trend.

(Disclaimer: The views/suggestions/advises expressed here in this article is solely by investment experts. Zee Business suggests its readers to consult with their investment advisers before making any financial decision.)

Stock Market LIVE: IPO Watch: Anil Singhvi's recommendations

Keystone Realtors IPO Preview:

BUY POST LISTING OR HIGH RISK TAKING INVESTORS APPLY FOR LONG TERM

Positives:

Quality brand name

Strong cash flow due to asset light model

Negatives:

Focus only in Mumbai region

Promoters to reduce stake from 87% to 75% in future

Maintaining high margin could be a challenge

Valuations not attractive